Bankruptcy rates climbing in Manitoba; what areas of the province are hardest hit?

As prices on everything continue to rise across the country, more Manitobans are filing for bankruptcy according to new data from the federal government.

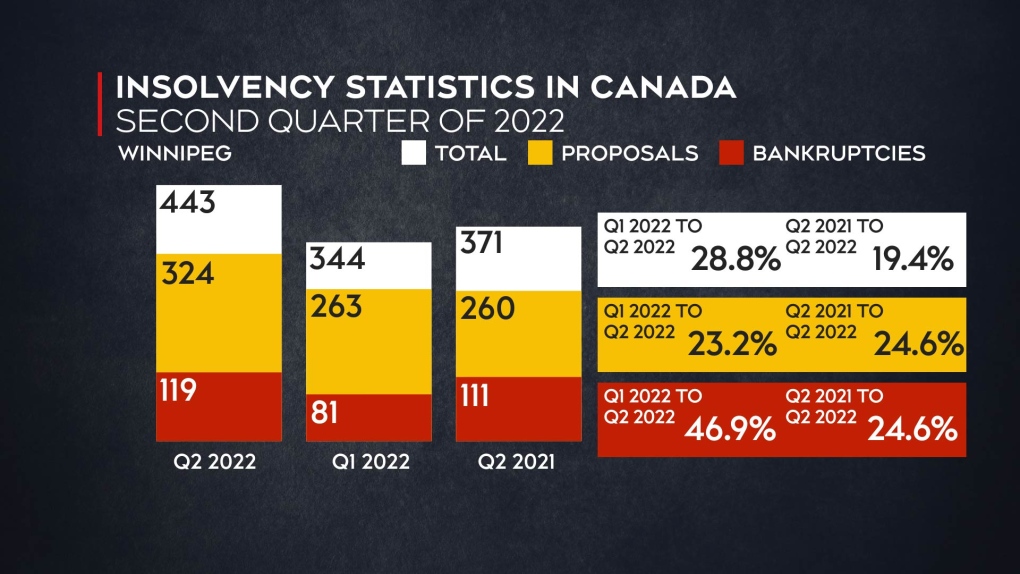

The second quarter report in 2022 for insolvency statistics in Canada shows Winnipeggers over the last three months have been filing for bankruptcy more compared to the previous quarter by nearly 47 per cent.

It is even higher for the province as a whole as Manitoba sits at 50 per cent.

Looking at the year-over-year numbers, Winnipeg is up 7.2 per cent with 119 filings in 2022 compared to 111 in 2021. In Manitoba, filings have actually dropped since 2021 by 4.4 per cent going from 204 to 195.

Winnipeg and Manitoba's numbers are significantly larger than the national average of just a nine per cent increase from last quarter and last year dropped by 11.1 per cent.

Brad Milne, a licensed insolvency trustee based in Brandon, said these numbers show Manitoba is getting back to pre-pandemic levels.

"When you look at 2019 to 2020, in Manitoba, the filing numbers actually decreased by about 20 per cent and then the subsequent year they decreased by another one per cent," said Milne. "Canada saw a larger decrease in that filing period, approximately 37 per cent."

He said numbers decreased because the government stepped up with emergency benefits, collection agencies weren't calling people and Canadians didn't spend money because there was nothing to spend money on.

Debt proposals have also seen a jump in the province and in Winnipeg.

The government says a proposal is "an offer to creditors to settle debts under conditions other than the existing terms. A proposal is a formal agreement under the Bankruptcy and Insolvency Act."

In Manitoba, proposals are up since last quarter by 15.2 per cent and 17.3 per cent compared to this time last year.

Those numbers are even higher in Winnipeg; 23.2 per cent compared to last quarter and 24.6 per cent since quarter two of 2021.

Proposal numbers are a little closer for all of Canada, up 9.3 per cent from last quarter and up 20.6 per cent since last year.

"Now as we emerge in 2022 out of that, the benefits are pretty much over, people are resuming their normal activities, collection agencies are back doing their thing, and so we're almost going back to, in my opinion, to our normal ways."

Milne said it is unusual to see such a large change in Manitoba compared to the national average.

He recommends people review their finances every month and look at areas where they can cut costs.

BREAKING DOWN EACH REGION IN MANITOBA - SOUTHEAST

In the southeast part of the province, bankruptcies numbers are up 62.5 per cent since last quarter, going from 8 filings to 13, but since last year, they are down 45.8 per cent.

For proposals, they're up 10.7 per cent since quarter one and up 19.2 per cent since 2021.

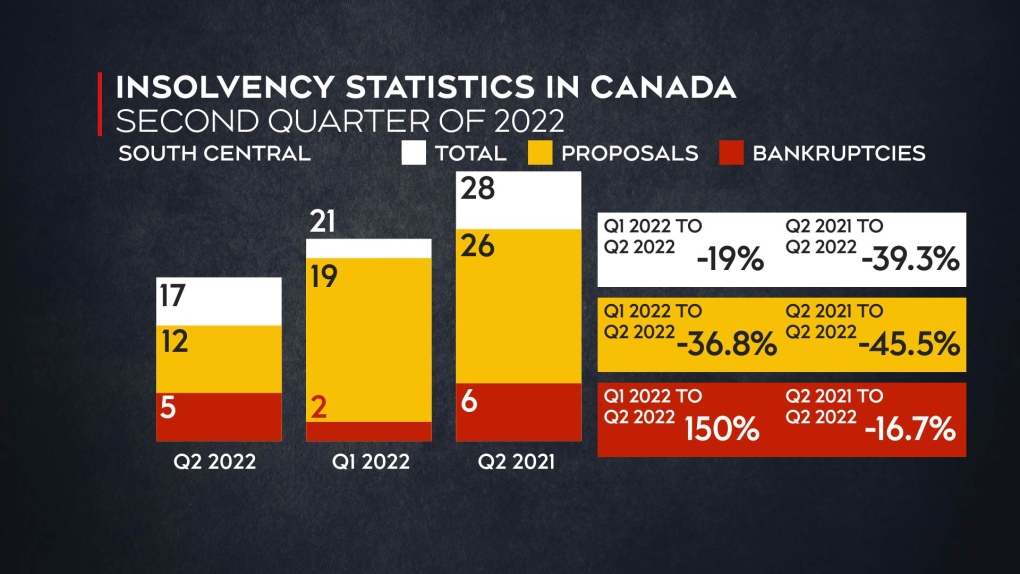

SOUTH CENTRAL

The bankruptcy percentage seems worse than the actual filings. The area is up 150 per cent quarter to quarter but that is going from two filings in quarter one to five in quarter 2.

The year-over-year number only went down by one filing.

Proposals dropped 36.8 per cent from 19 to 12 per quarter and 45.5 per cent since 2021, when there were 22 proposals filed.

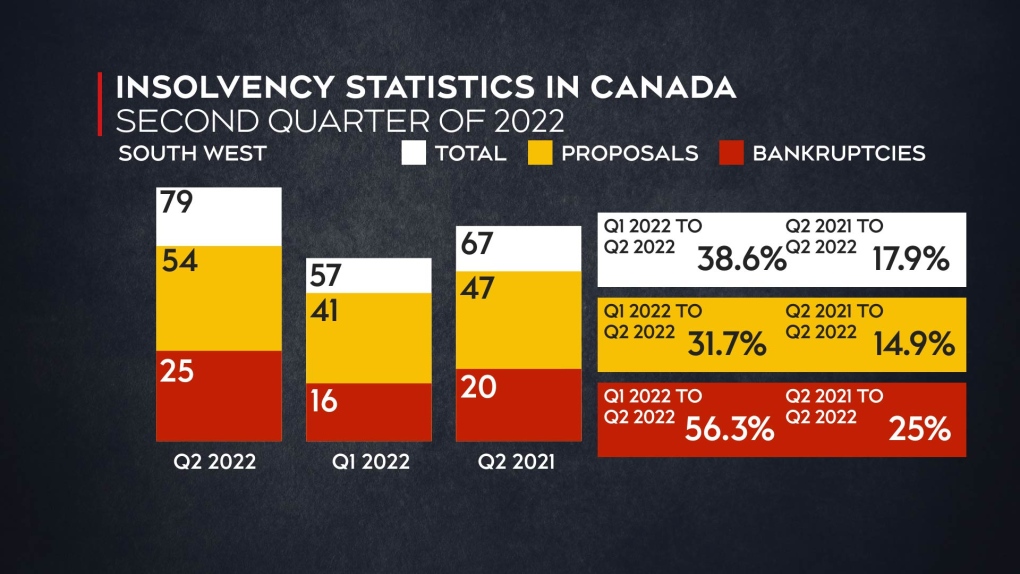

SOUTHWEST

Bankruptcies were up 56.3 per cent in the southwest region going from 16 last quarter to 25 this quarter, but year-over-year is less at just 25 per cent.

When it comes to proposals, there were 41 in quarter one of 2022, compared to 54 in quarter two for a 31.7 per cent increase. There were 47 proposals filed last year for an increase of 14.9 per cent.

NORTH CENTRAL

The north-central region has been stable quarter to quarter when it comes to bankruptcies with no change in the number of filings – three each quarter.

There has also been a decrease of 62.5 per cent from 2021, when there were eight filings.

Proposals also dropped per quarter from 13 to 12, but are up 50 per cent from 2021 when there were eight.

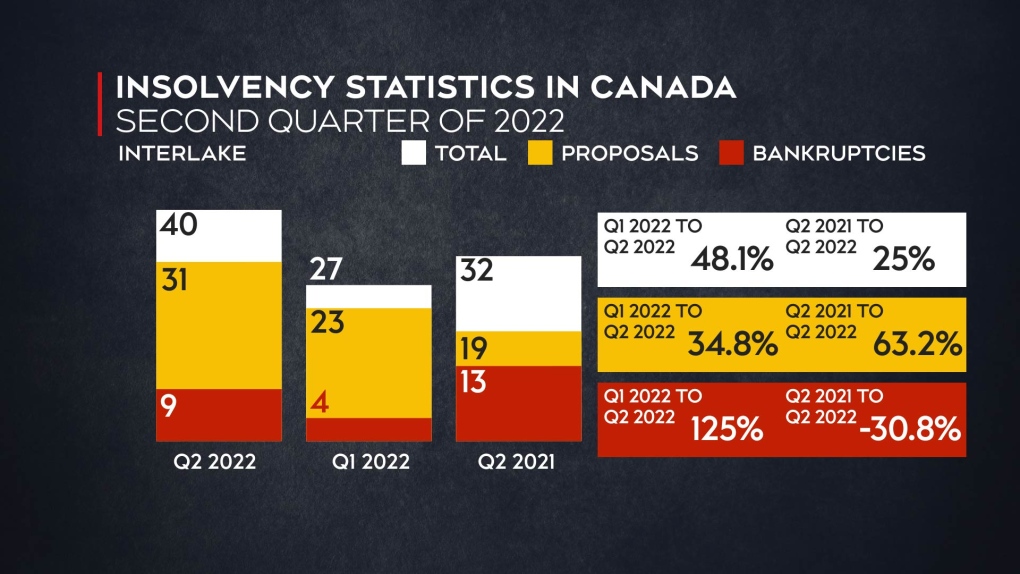

INTERLAKE

The Interlake saw a jump in bankruptcies in the second quarter going from four to nine, but still a drop from last year at 13 filings.

However, proposals went up 34.8 per cent – 23 in quarter one and 31 in the second quarter.

They are up 63.2 per cent year-over-year from 19 in 2021.

PARKLANDS

The Parklands' numbers were marginal, with two bankruptcy filings last quarter and five in quarter two. However, it's still a decrease from last year when there were eight.

Looking at proposals, they are up slightly in quarter two from 10 to 15 and there were 14 in 2021.

NORTH

In the north, bankruptcy dropped from six to three and only four declarations were made in 2021.

Proposals also dropped this quarter, from 15 to nine and there were 18 in 2021.

CTVNews.ca Top Stories

DEVELOPING Person on fire outside Trump's hush money trial rushed away on a stretcher

A person who was on fire in a park outside the New York courthouse where Donald Trump’s hush money trial is taking place has been rushed away on a stretcher.

Mandisa, Grammy award-winning 'American Idol' alum, dead at 47

Soulful gospel artist Mandisa, a Grammy-winning singer who got her start as a contestant on 'American Idol' in 2006, has died, according to a statement on her verified social media. She was 47.

She set out to find a husband in a year. Then she matched with a guy on a dating app on the other side of the world

Scottish comedian Samantha Hannah was working on a comedy show about finding a husband when Toby Hunter came into her life. What happened next surprised them both.

'It could be catastrophic': Woman says natural supplement contained hidden painkiller drug

A Manitoba woman thought she found a miracle natural supplement, but said a hidden ingredient wreaked havoc on her health.

Young people 'tortured' if stolen vehicle operations fail, Montreal police tell MPs

One day after a Montreal police officer fired gunshots at a suspect in a stolen vehicle, senior officers were telling parliamentarians that organized crime groups are recruiting people as young as 15 in the city to steal cars so that they can be shipped overseas.

Vicious attack on a dog ends with charges for northern Ont. suspect

Police in Sault Ste. Marie charged a 22-year-old man with animal cruelty following an attack on a dog Thursday morning.

Senators reject field trip to African Lion Safari amid elephant bill study

The Senate legal affairs committee has rejected a motion calling for members to take a $50,000 field trip to the African Lion Safari in southern Ontario to see the zoo's elephant exhibit.

Tropical fish stolen from Beachburg, Ont. restaurant found and returned

Ontario Provincial Police have landed a suspect following a fishy theft in Beachburg, Ont.

DEVELOPING G7 warns of new sanctions against Iran as world reacts to apparent Israeli drone attack

Group of Seven foreign ministers warned of new sanctions against Iran on Friday for its drone and missile attack on Israel, and urged both sides to avoid an escalation of the conflict.