Chinese companies have stopped buying canola seed from Canadian producers, says an industry group, leaving exporters trying to sell their supply to other markets.

The ongoing trade dispute that started earlier this month when China revoked the permit of a major Canadian exporter is also hitting canola farmers, who are grappling with lower prices and delayed shipments.

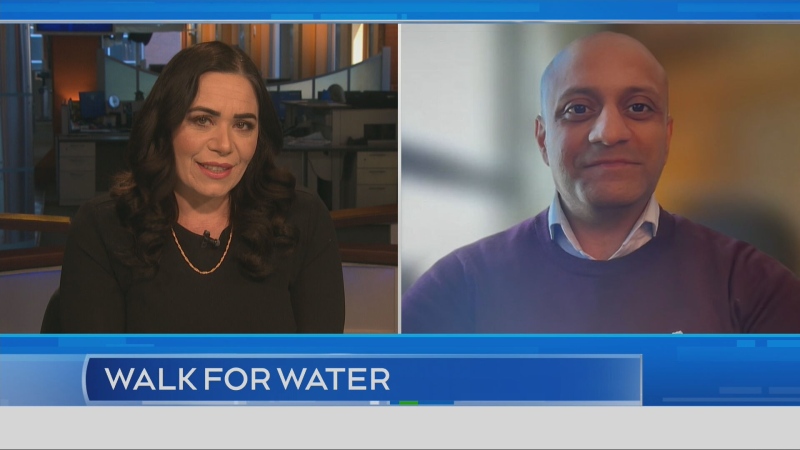

"Chinese buyers became uninterested in buying Canadian canola," said Brian Innes, vice-president of public affairs for the Canola Council of Canada.

The change from a market that accounts for about 40 per cent of Canada's canola seed, oil and meal exports came after the formal notification that China blocked imports from one of Canada's largest grain producers, Richardson International Ltd., he said. The Chinese decision cited an alleged detection of hazardous organisms in the company's product.

All of the council's members that export canola from Canada to China have reported that Chinese importers are currently unwilling to purchase their product, Innes said. Council members include Viterra Inc., Louis Dreyfus Company, Cargill Ltd. and Parrish & Heimbecker Ltd.

"What we understand is that the concern or the reluctance of Chinese buyers to purchase Canadian canola is not coming from their concern about the quality of our product," he said, adding they've had no quality questions from other markets.

Innes said he can't speculate on where the reluctance is coming from.

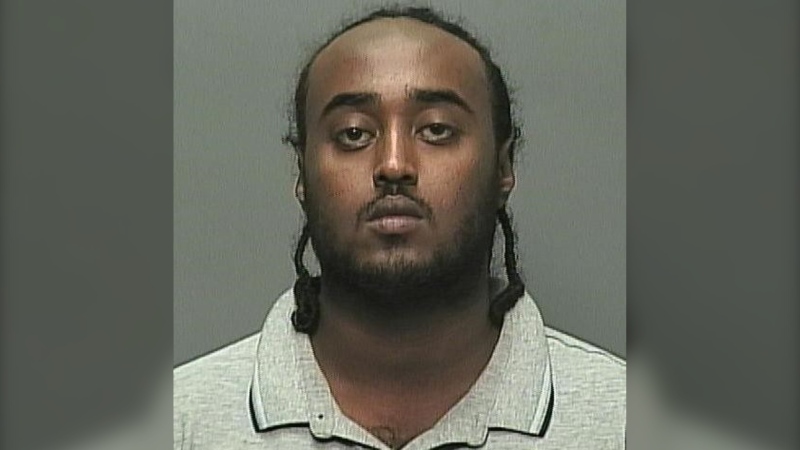

At the time of the Richardson announcement, some suggested the move could be retaliation for Canada's arrest of a top Chinese tech executive. In December, Canadian authorities arrested Huawei Technologies Co. Inc. senior executive Meng Wanzhou in Vancouver at the behest of the United States.

The council said canola exporters are now looking at other markets, including Japan, Mexico, the United States, the United Arab Emirates, Pakistan, Bangladesh and Europe.

"It's very difficult to replace a market that takes as much as China takes," said Innes. In 2018, canola seed exports to China were worth $2.8 billion, according to the council.

The most immediate problem though, Innes said, is a drop in price for the commodity, especially for farmers who still have unsold canola from last year's crop.

"That canola is worth less now than it was a month ago."

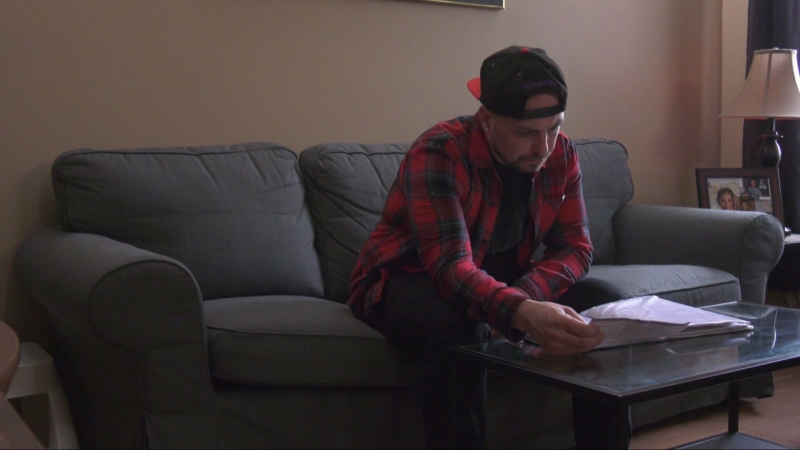

David Reid, 42, is a partner at the family farm he grew up on in Cremona, Alta. -- about 90 kilometres northwest of Calgary. Canola accounts for about 30 per cent of what the farm produces.

The farm sells to a company that exports the product to other places, like China, but after Richardson's permit was revoked Reid said shipments slowed and he saw an immediate price drop for his product.

Prices fell by a dollar a bushel, he said, which he estimated to be a 12 per cent fall.

The price of the commodity also fell in futures contract trading since Wanzhou's arrest. The May canola futures contract was trading at $451.20 per tonne Friday afternoon -- down nearly 3.8 per cent.

Reid is now holding on to more of his product in hopes the price will rise.

"We don't know how long we might have to wait for the price to increase," he said, adding that while it's possible to store the product for a long time, bin space will become an issue by the fall when he'll need room for the next canola crop.

He has already sold some product at the lower price, which hurts his bottom line.

"Everybody's feeling it for sure," he said of other canola farmers he knows.

Innes stressed that technical discussions between Canadian and Chinese scientific experts are continuing, and these talks are very important to resolve this disagreement.

Still, he believes the fundamentals of the canola trading relationship between the two countries are very strong.

"China has a need and a desire to have canola. They need healthy oil. They need protein to feed their animals," he said.

"And we believe that the fundamental market demand in China will continue to be there."