GIS clawback impacting low income seniors

Mary Lou Bourgeois lost her job because of COVID-19.

As a result, she collected pandemic benefits offered by the federal government including the CERB and the CRB.

She stopped getting those supports when she hit her retirement age this summer.

“It took me to my 65th birthday and I thought, ‘Great, now I don’t have to worry about looking for a job, you know, I can get my pensions, I’ll get this GIS,’” said Bourgeois.

GIS is the Guaranteed Income Supplement: a monthly payment for low-income seniors over 65 up to $948 a month.

When Bourgeois went to apply for it, she was turned down because her pandemic supports were counted as income, pushing her above the baseline for GIS.

“I was dumbfounded,” said Bourgeois. “I couldn’t believe it because I thought, ‘Well, how could you say I made too much money when that money is only enough just to get by?’”

NDP MP Leah Gazan said many low-income seniors are being caught off guard by this.

“This is resulting in seniors becoming unsheltered, having to choose between medication and food,” said Gazan.

In some cases, she said monthly GIS payments are dropping from $600 to $60.

“The paying back of the COVID pandemic debt shouldn’t be on the backs of seniors. The government needs to reverse this decision,” said Gazan.

In a statement, the federal government said the Old Age Security Act stipulates any earnings considered net income under the Income Tax Act are used to calculate GIS entitlements.

“Pandemic-related benefits, such as the Canada Emergency Response Benefit (CERB) and the Canada Recovery Benefit, are considered taxable income. These benefits are therefore considered income for GIS purposes.”

Ottawa also points out during the pandemic it provided one-time tax-free payments worth hundreds of dollars for OAS pensioners and GIS recipients, and they did not count as income towards GIS.

“In July 2020, the Government provided a one-time tax-free payment of $300 for seniors eligible for the OAS pension, with an additional tax-free payment of $200 for seniors eligible for the GIS. Allowance recipients also received $500.”

Bourgeois said she doesn’t want to look for another job because she suffers from fibromyalgia which tires her out.

She said she needs the GIS now to pay for medication and other bills.

“I’m only making enough money to pay my rent right now and get some groceries and that’s it,” said Bourgeois. “Last month I borrowed money from a friend -- $1,000.”

CTVNews.ca Top Stories

Pedestrian, baby injured after stroller struck and dragged by vehicle in Squamish, B.C.

Police say a baby and a pedestrian suffered non-life-threatening injuries after a vehicle struck a baby stroller and dragged it for two blocks before stopping in Squamish, B.C.

Senate expenses climbed to $7.2 million in 2023, up nearly 30%

Senators in Canada claimed $7.2 million in expenses in 2023, a nearly 30 per cent increase over the previous year.

Demonstrators kicked out of Ontario legislature for disruption after failed keffiyeh vote

A group of demonstrators were kicked out of the legislature after a second NDP motion calling for unanimous consent to reverse a ban on the keffiyeh failed to pass.

Tom Mulcair: Park littered with trash after 'pilot project' is perfect symbol of Trudeau governance

Former NDP leader Tom Mulcair says that what's happening now in a trash-littered federal park in Quebec is a perfect metaphor for how the Trudeau government runs things.

RCMP uncovers alleged plot by 2 Montreal men to illegally sell drones, equipment to Libya

The RCMP says it has uncovered a plot by two men in Montreal to sell Chinese drones and military equipment to Libya illegally.

Government agrees to US$138.7M settlement over FBI's botching of Larry Nassar assault allegations

The U.S. Justice Department announced a US$138.7 million settlement Tuesday with more than 100 people who accused the FBI of grossly mishandling allegations of sexual assault against Larry Nassar in 2015 and 2016, a critical time gap that allowed the sports doctor to continue to prey on victims before his arrest.

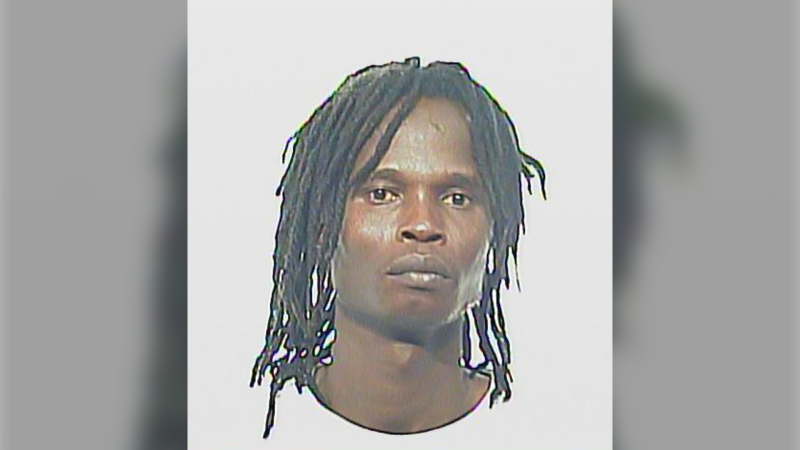

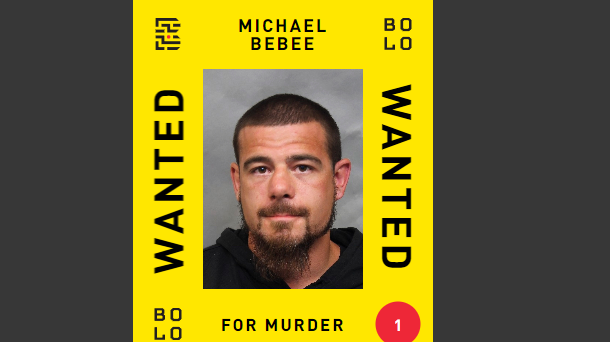

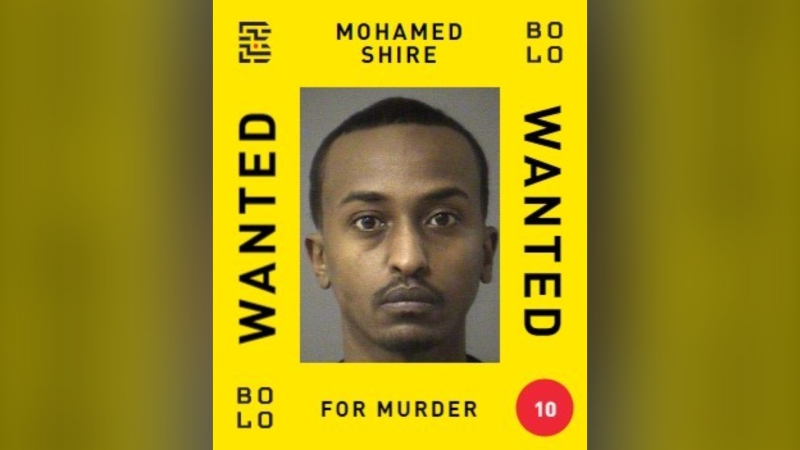

Man wanted in connection with deadly shooting in Toronto tops list of most wanted fugitives in Canada

A 35-year-old man wanted in connection with the murder of Toronto resident 29-year-old Sharmar Powell-Flowers nine months ago has topped the list of the BOLO program’s 25 most wanted fugitives across Canada, police announced Tuesday.

Doctors ask Liberal government to reconsider capital gains tax change

The Canadian Medical Association is asking the federal government to reconsider its proposed changes to capital gains taxation, arguing it will affect doctors' retirement savings.

Pro-Palestinian protests roiling U.S. colleges escalate with arrests, new encampments and closures

The student protests of Israel's war with Hamas that have been creating friction at U.S. universities escalated Tuesday as new encampments sprouted and some colleges encouraged students to stay home and learn online, after dozens of arrests across the country.