WINNIPEG -- Accountants have been busy fielding questions about a new tax deduction for people who’ve been working from home because of COVID-19.

The Canada Revenue Agency is broadening the eligibility for people with home office expenses to include a wider range of workers.

The move is aimed at covering some of the costs associated with running a temporary workspace during the pandemic, but it won’t cover everything.

Chartered accountant Mark Jones said anyone who worked from home half the time over a period of at least four consecutive weeks last year is eligible.

“That could be one day in the office, one day at home,” said Jones. “As long as it’s more than 50 per cent of the time.”

There’s a detailed way to apply or a simple approach, known as the flat rate method. The flat rate method doesn’t require employers to sign forms. Workers can claim a deduction of $2 a day for each day they worked from home up to a maximum of $400.

“It’s a one-page form. It’s really simple. How many days times $2, that’s it,” said Jones. “There's no square footage calculations there’s no receipts required.”

Then there’s the more detailed approach which requires you to determine the size of your home workspace and submit receipts, records and documentation of your actual expenses.

“Rent paid for the house or apartment, electricity, maintenance,” Jones cited as examples. “You can’t claim mortgage payments. You can’t claim mortgage interest payments.”

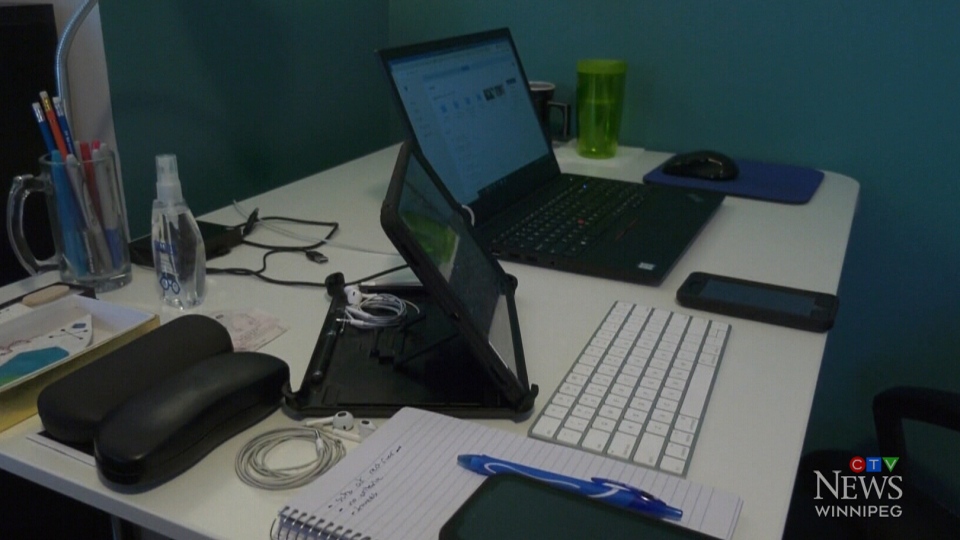

Under the detailed method, supplies like pens, paper and pencils can be claimed if you submit receipts and haven’t or won’t be reimbursed by your employer.

Monthly internet fees can be claimed. Cell phone expenses can also be claimed if you can prove they’re related to work.

But not all your big home office purchases, like laptops and computers, are included.

“It won’t cover things like furniture, desks, chairs, anything like that,” said Jones. “It won’t cover electronics. You needed speakers, you needed computer accessories, it doesn’t cover any of that.”

It means employees like Apollo Gale, 19, will be able to claim some but not all expenses on their personal income tax return for the 2020 tax year.

“Probably getting like a desk and a chair, I didn’t have one before, that was kind of my biggest cost,” said Gale.

While it may not offset all costs, Gale is glad some expenses related to working from home are included.

“It’s something you have to do your research for,” Gale said. “A lot of people my age, especially a lot of my friends, they don’t know how to do their taxes. Their parents still do it for them, but I moved away from my parents so I’m kind of on my own figuring it out for the first time.”

If multiple people are working from the same home, the Canada Revenue Agency said they can each use the temporary flat rate method to calculate their own tax deduction for home office expenses.

While you can’t claim expenses you’ve already been reimbursed for or will be reimbursed for, you can still use the temporary flat rate method or the detailed method for other home office expenses which haven’t been paid for by your employer.

As for which approach is more beneficial, the simple or detailed one, Jones said it really depends on each person.

A full breakdown of what’s included and what’s not can be found on the Canada Revenue Agency’s website.