‘We'd have to strip her down’: Insurance issues concerning mobile home owner in Manitoba

A mobile home owner could potentially be out thousands of dollars after learning her home might not be insurable.

Inside of Gloria Prichard’s RM of Norfolk Treherne mobile home, everything has been redone – from sewage, to wiring, to a new roof.

There’s only one thing left for complete her top to bottom renovation, excluding the frame.

"Once the siding is up that's it. There's nothing left to do on the trailer,” Pritchard said.

The 74-year-old returned to the workforce three years ago to pay for renovations for the 49-year-old home. But after a visit to her insurance broker - she learned her home insurance expires when her home turns 50.

"He hasn't even found another agency that would insure. So at this point there is nobody. So what do you do?"

Rob de Pruis, the national director of consumer and industry relations for Insurance Bureau of Canada, says many agencies are hesitant to insure mobile homes once they turn 30.

"Components are at least 30 years old and sometimes more,” de Pruis said. “Because insurance is about risk it could be a bit more difficult to find the right insurance coverage."

de Pruis says it is possible to insure an older mobile home - and documented improvements will help.

The Wawanesa Mutual Insurance Company - a company Pritchard had hoped to insure with, says in a prepared statement they do not insure older mobile homes.

"Older mobile homes have different coverage needs than Wawanesa is set up to provide,” it said. “We recommend that anyone with an older mobile home work with an independent insurance broker, as they are in the best position to help find the right insurance coverage."

Pritchard says if she can't insure it - she will lose her investments if something happens to the home or she moves.

"I would of course live in it as long as I can and then when I'm ready to move or pass on, then we'd have to strip her down,” she said.

Pritchard worries for other mobile home owners, including her neighbours who live in older mobile homes, might be unaware of the insurance issue.

For those who do have an older mobile home - the Insurance Bureau of Canada recommends bringing documents and photographs of home improvements to insurance brokers - and to shop around.

CTVNews.ca Top Stories

BREAKING Iran fires air defence batteries in provinces as explosions heard near Isfahan

Iran fired air defence batteries early Friday morning as explosions could be heard near a major air base near Isfahan, raising fears of a possible Israeli strike following Tehran's unprecedented drone-and-missile assault on the country.

American millionaire Jonathan Lehrer denied bail after being charged with killing Canadian couple

American millionaire Jonathan Lehrer, one of two men charged in the killings of a Canadian couple in Dominica, has been denied bail.

Nearly half of China's major cities are sinking, researchers say

Nearly half of China's major cities are suffering 'moderate to severe' levels of subsidence, putting millions at risk of flooding especially as sea levels rise.

Prince Harry formally confirms he is now a U.S. resident

Prince Harry, the son of King Charles III and fifth in line to the British throne, has formally confirmed he is now a U.S. resident.

Judge says 'no evidence fully supports' murder case against Umar Zameer as jury starts deliberations

The judge presiding over the trial of a man accused of fatally running over a Toronto police officer is telling jurors the possible verdicts they may reach based on the evidence in the case.

Health Canada to change sperm donor screening rules for men who have sex with men

Health Canada will change its longstanding policy restricting gay and bisexual men from donating to sperm banks in Canada, CTV News has learned. The federal health agency has adopted a revised directive removing the ban on gay, bisexual and other men who have sex with men, effective May 8.

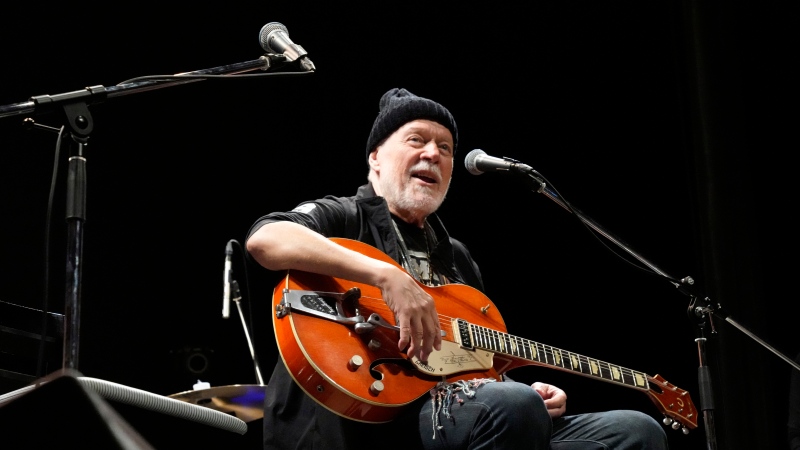

Colin Jost names one celebrity who is great at hosting 'Saturday Night Live'

Colin Jost, who co-anchors Saturday Night Live's 'Weekend Update,' revealed who he thinks is one of the best hosts on the show.

Sports columnist apologizes for 'oafish' comments directed at Caitlin Clark. The controversy isn't over

A male columnist has apologized for a cringeworthy moment during former University of Iowa superstar and college basketball's highest scorer Caitlin Clark's first news conference as an Indiana Fever player.

'Shopaholic' author Sophie Kinsella reveals brain cancer diagnosis

Sophie Kinsella, the best-selling author behind the 'Shopaholic' book series, has revealed that she is receiving treatment for brain cancer.