WINNIPEG -- The Manitoba government is giving $120 million to help small and medium-sized businesses that have been impacted by COVID-19.

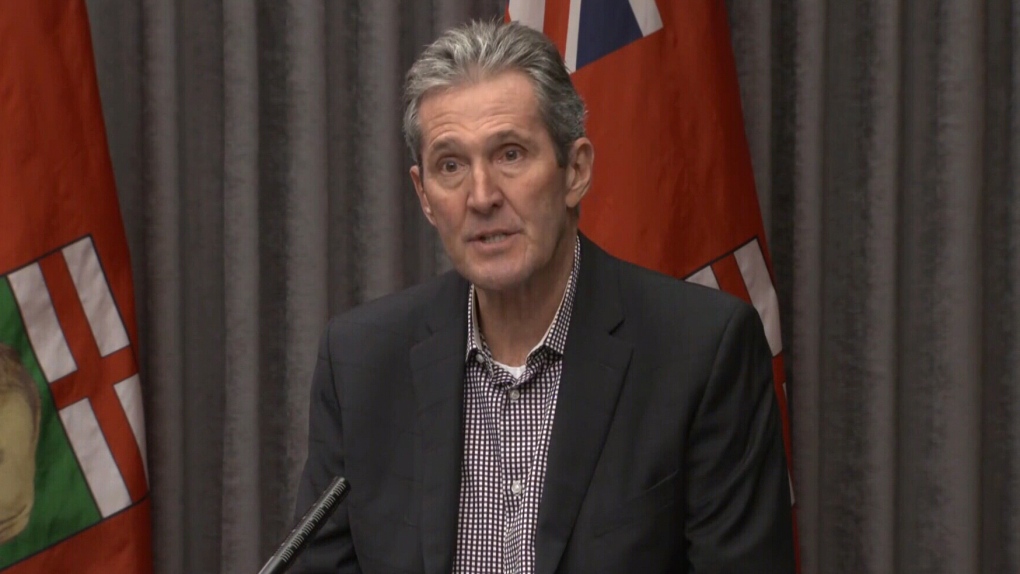

Premier Brian Pallister made the announcement at a news conference on Wednesday, saying small businesses are the backbone of our economy and are bearing the brunt of the pandemic, along with frontline workers.

“They are going to be the key to our recovery,” said Pallister, referring to small and medium-sized businesses.

“And we want to position them in a way that they’ll be able to help themselves bounce back and in doing so, help all of us to bounce back from this economic crisis.”

The Manitoba Gap Protection Program (MGPP) will be available for about 120,000 businesses in the province who don’t qualify for federal government programs and wage subsidies.

The province said it will give eligible businesses the non-interest, forgivable MGPP loan of $6,000. It noted the loan will be forgiven on Dec. 31, 2020, if the business says it hasn’t received any major non-repayable COVID-19 support from the federal government, as well as sector-specific grant programs.

If the business has received benefits from a federal program, the MGPP loan will be added to its 2020 tax bill.

Pallister emphasized the fact that these measures will not restore everything businesses have lost from the global pandemic, saying “nothing can do that.”

“But it will help them bridge through the valley to a stronger and better future and that’s what we all want,” he said.

The premier noted the government has worked with chambers of commerce, business and retail councils, industry and trade associations, as well as stakeholders to identify where the greatest need is, in order to recover the province’s business sector.

“We believe that tens of thousands of Manitoba businesses will be eligible for federal support programs, some which may be announced in the future, many have been announced already,” he said.

Pallister noted these federal programs do have gaps.

“We’re focused on our plan in filling those gaps, so that people don’t fall through them and suffer further damage added to what they’ve already suffered,” he said.

In order to be eligible for this loan, businesses must:

- Have been operational on March 20, 2020, the day the Manitoba government declared a state of emergency;

- Have temporarily stopped or reduced operations due to the public health orders put in place due to COVID-19;

- Be registered and in good standing with the Manitoba Business and Corporate Registry;

- Have not qualified for federal COVID-19 grant support; and

- Have an email address and bank account.

During the news conference, Pallister said he wouldn’t be speaking to the public today as the premier if it weren’t for the support of small businesses.

“Small businesses that gave me the opportunities to have initially some seasonal employment to save up to go on to university. Small businesses like the one I was raised in, a small family farm,” he said.

“You learn a lot of lessons from these experiences and I have a great appreciation for the small business community in the province. I come from that world, started my own business and I understand the risks and the hopes and the possibilities that exist within the small businesses of our province.”