As millions of mortgages come up for renewal, how can you save money? Winnipeg brokers weigh in

More than two million Canadians will renew their mortgages over the next year-and-a-half. CTV News asked more than 50 mortgage brokers across Canada how to get the best mortgage deal. Here’s what we found from the four brokers we spoke to in Winnipeg.

As mortgage renewals surge across the country, CTV News Winnipeg asked several mortgage brokers in Winnipeg what residents should consider when refinancing a mortgage.

“When we look at 2023, we are actually seeing a little over 1 million mortgages that were renewed during that period,” said Tania Bourassa-Ochoa, Deputy Chief economist with Canadian Mortgage and Housing Corporation (CMHC), adding at least 2 million more mortgages will be renewed over the next three years.

According to the most recent data from CMHC, the average mortgage price in Winnipeg has been steadily increasing, sitting at $1,598 as of the fourth quarter of 2023. Winnipeg’s mortgage rates are still below the national average, which sits at $2,143.

Mortgage delinquencies have also been steadily rising across Canada, including in Winnipeg, which saw a marked increase in the past year.

Niverville homeowner Karen Huyghebaert said the recent interest rate increases have made her variable fixed-term mortgage difficult to manage.

“It almost feels like we're behind again because the interest rates have gone up so much,” she said, adding that now she has to think carefully about where to spend money.

“We're very privileged in that it's not a huge struggle to get by,” she said, but when it comes to spending on anything beyond the basics, it’s getting out of reach for her family.

“Those extra things that people want, like maybe you want a cabin, maybe you want to go on a nice vacation,” she said, “You know, it's more difficult to plan for those things when you're paying more monthly for your mortgage.”

CTV News Winnipeg surveyed four mortgage brokers, asking the same questions about the type of mortgage, their best possible rate right now, getting out a variable rate mortgage, and opting for a longer amortization period.

The results were mixed across the board but all agreed a longer period to pay off a mortgage is a sound decision- depending on the economic situation of homeowners.

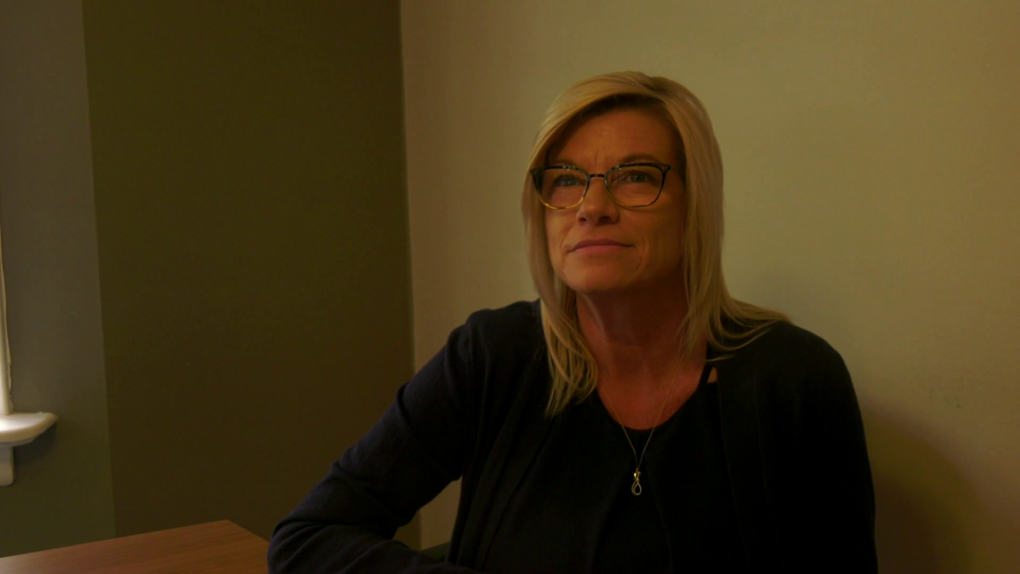

Shirl Funk speaks about mortgage renewal in May 2024. (Jeff Keele/CTV News Winnipeg)

Shirl Funk speaks about mortgage renewal in May 2024. (Jeff Keele/CTV News Winnipeg)

All mortgage brokers in Canada are governed under strict federal and provincial laws which include a requirement to report any earnings they receive from banks for client referral and getting the best rate means repeat business.

For independent broker Shirl Funk, it comes down to the individual and their level of comfort with risk and safety.

“If they can manage the affordability of the variable rate, I say stay there, because rates could drop at any time,” she said. “If you want to go fixed, you can change it then.”

Funk said she is putting clients in two to three-year rates for mortgages.

“Because of the high rates right now, we don't want to lock them in too long, put them in a five year, and then rates all of a sudden jumped down a couple of points,” she said. “Now they're stuck there. So we're just doing two, three-year terms. And hopefully, rates come down, and we'll refinance them at that time.”

Chad Wilson with Ideal Mortgage Solutions believes the worst of the rate increases are in the past and they will start falling.

“You're about to see the other side of the pain that you've just gone through over the last two years,” he said. “We saw a significant increase in the benchmark rates in the Bank of Canada over the last 24 months. Those were geared at trying to tame inflation, they have done their job. And going forward, we should see the other side of this. I mean, the normalized interest rates are not going to be the pandemic-level interest rates. We need to all understand that. But certainly, we should see some reductions in that prime rate over time.”

Wilson said the most important thing for people choosing a mortgage is ensuring they’re financially stable.

“Payment stability is, is the most important consideration when renewing your mortgage,” he said. “This is a roof over your home, it's not something you should gamble with.”

The Bank of Canada will announce the next interest rates on Wednesday morning. The Bank of Canada has held steady at a five per cent interest rate since July 2023.

If the Bank of Canada decides to cut rates, it will be the first cut since March 2020, when the COVID-19 pandemic took hold.

BEST RATE DEPENDS ON SEVERAL FACTORS

The best rate on a five-year fixed mortgage that could be obtained right now all came in at 4.89 per cent and a variable rate topped out at 6.2 per cent, but as broker Beth Thrall pointed out, it is not always about the “best” rate.

“Reason being is, with, rates come other factors,” she wrote in her survey, “Such as prepayment privileges and penalty calculations.”

Beth Thrall with Homework Mortgages powered by Mortgage Architects. (Facebook)

Beth Thrall with Homework Mortgages powered by Mortgage Architects. (Facebook)

She said that other factors like switching lenders and adding funds to your mortgage can also affect the interest rate.

Mortgage broker Ron Chan said mortgage debt is not to be gambled with.

“It provides your family with shelter and should be a boring part of your financial portfolio,” he said, “Payment stability is extremely important and that has proven itself over the past couple of years.”

All the brokers agree you should consult with a professional you trust and, the bottom line is self-education.

“Advice is great but you should ensure you are making an educated decision on your largest financial liability and largest financial asset,” Thrall said, “Reach out to a mortgage agent you trust.”

Ron Chan INVIS Mortgages. (Supplied )

Ron Chan INVIS Mortgages. (Supplied )

Responses to CTV News' Mortgage Broker Questionnaire

All questions based on a typical Canadian household renewing a mortgage

Broker Name: Beth Thrall

Broker Company: Homework Mortgages powered by Mortgage Architects

Question #1: What is the best type of mortgage to have right now?

The best type of mortgage is really going to be consumer-based. There should never be a definitive answer. Factors to consider would be, how long do they intend to stay in that home, what is their monthly cash flow like, what are their main financial goals with having a mortgage. If you have someone just telling you what to do with your mortgage, you should be asking more questions and educating yourself more.

Question #2: What is the best rate you can get right now? (Specify rate and term length.)

It is not always about the “best rate.” Reason being, is with rates comes other factors. Such as prepayment privileges and penalty calculations. Mortgage rates are also determined whether it’s a switch from one lender to another. If your original mortgage has default insurance. If you are looking to add funds to your mortgage and not renewing, it would provide a different interest rate as well.

Question #3: Should I get out of my variable mortgage if I have one?

This is also a case-by-case scenario. If the variable is really affecting your monthly cash flow than revisit and look at going to a fixed rate. However, if you took a variable rate mortgage there was a reason you took it. Historically variable rate mortgages have less interest than fixed rates. Yes, we went through unprecedented times in 2022/2023 in the increase in prime. However, if you adjusted your monthly budget to reflect your increasing mortgage payments, you may be better off at renewal time as you have adjusted that budget already. As opposed to those that would have locked into a lower fixed rate during that time. They will be in larger payment shock.

Question #4: Should I opt for a longer amortization period?

Some people will look at extending their amortization back out on their mortgage at renewal. This helps cut the monthly payments with the higher rates. For clients that look at doing this, my education to them will be, when the mortgage is up for renewal again, the hope is rates will be more stable and they can keep their payments at the same amount. That way they can catch back up on their amortization period. Other pieces we are finding, is with house prices being higher than the 80/90’s. Many people have changed this mind set on paying off their mortgages as fast as possible. Especially in cases where a mortgage payment is less than rent. Depending on what their bigger financial plan is increasing their amortization back out isn’t always a bad decision.

Question #5: Can I trust a bank for mortgage renewal advice?

Question #6: What piece of advice would you pass on to anyone looking to renew their mortgage?

My background comes from working at a bank for many years. I learnt quickly my passion was real estate and mortgages which is how I transitioned to becoming a mortgage agent. I took my passion of mortgages to help build trust and educate my clients at renewal. Not everyone is going to be like me. When dealing with the bank, the staff have to be the jack of all trades. It can be challenging for them to know all the ins and outs of mortgages, mortgage rates, economy, rate predictions, competitor rates and more. Before signing the mortgage renewal documents provided by the bank, educate yourself first. Reach out to a mortgage agent that you can trust. Advice is great but you should be ensuring you are making an educated decision on your largest financial liability and largest financial asset.

Broker Name: Ron Chan

Broker Company: INVIS Mortgages

Question #1: What is the best type of mortgage to have right now?

VARIABLE RATE FIXED RATE

Tough question to answer as the best type of mortgage fixed or variable is unique to every household. Choice will depend on what their outlook is on various fronts: general economic outlook, personal outlook, future planning, risk tolerance, etc.

Question #2: What is the best rate you can get right now? (Specify rate and term length)

VARIABLE RATE FIXED RATE

Insured rates as that’s the majority of people getting mortgages these days:

-1 year 6.69% fixed

-2 year 6.04% fixed

-3 year 4.94% fixed

-4 year 4.94% fixed

-5 year 4.89% fixed

-5 year variable Prime -1%, prime = 7.20%

Question #3: Should I get out of my variable mortgage if I have one?

YES NO IT DEPENDS

Goes back to circumstances of the client, in general, I would say no as the Bank of Canada is about to embark on a rate dropping cycle.

Question #4: Should I opt for a longer amortization period?

YES NO IT DEPENDS

Again, goes back to client needs and wants. If they have the ability to go for longer amortization and they’re looking to preserve cash flow - sure. But if you have less than 20% down payment (on a purchase) this option isn’t available to you. Furthermore, if you don’t have at least 20% equity in your home this option isn’t available either.

Question #5: Can I trust a bank for mortgage renewal advice?

YES NO IT DEPENDS

X*

*sure, but is it un-biased advice?

Question #6: What piece of advice would you pass on to anyone looking to renew their mortgage?

Don’t just shop and choose on rate alone. Terms and conditions of a mortgage are very important. Specifically, prepayment calculations on fixed-rate mortgages. Fixed rate mortgages have 2 calculations to determine prepayment or early payout of a mortgage. It’s the higher of 3 months’ interest or interest rate differential (IRD). In a falling mortgage rate environment breaking a mortgage early could be very costly. Especially if you choose the wrong lender. Every lender has a different way of calculating IRD, some are more favourable than others. Don’t just shop 5-year fixed-rate mortgages, choose your term that will coincide with your future plans – not many people pay attention to this. i.e., if your planning on moving in 3 years don’t choose a 5-year fixed rate mortgage – that opens you up to penalty risk.

Always consult a mortgage broker about your renewal. A good one will assess your situation and help you determine if your existing lender is competitive or if you should shop around. Or if you should take the opportunity to improve your financial situation i.e. refinance to lower interest costs associated with higher interest debt, etc.

Broker Name: Chad Wilson

Broker Company: Ideal Mortgage Solutions

Question #1: What is the best type of mortgage to have right now?

VARIABLE RATE FIXED RATE IT DEPENDS

Risk profiles of borrowers are all very different, so that is certainly a consideration.

- Fixed rates come with payment stability

- Variable rates are volatile and come with some risk. Speaking to an educated mortgage professional to make an informed decision is very important.

**Generally speaking, payment affordability, adjusted for the risk if you go variable should be the most important consideration. Fixed rates are winning in that category.

**Two kinds of variable rates: Adjustable payment, and Variable rate / static payment. ***Many banks and credit unions offer a static payment with their variable payment – I would not recommend them as they can add a significant amount of amortization to your mortgage, costing you much, much more over time.

Question #2: What is the best rate you can get right now? (Specify rate and term length)

VARIABLE RATE FIXED RATE IT DEPENDS

FIXED: 4.89% - 5 years

VARIABLE: 5 years Prime (7.2) – 1% = 6.2% currently

**Caveat – some mortgage products have come with less features and could have higher penalty calculations should they be paid out – understand the features of your mortgage, whether it be fixed or variable.

Question #3: Should I get out of my variable mortgage if I have one?

YES NO IT DEPENDS

The answer is not cut and dry. It depends on what kind of variable mortgage product you have. If the discount is around the 1% level, the damage is already done, and you’re about start a recovery. Remember the reason you took a variable to begin with. If you are prepared to gamble on interest rates falling 1-2% from current levels going forward, staying the course variable is likely the best choice.

If you have had, or foresee serious consequences to your family finances, you should be in a fixed rate with stable payment.

Question #4: Should I opt for a longer amortization period?

YES NO IT DEPENDS

Yes. Keep in mind that most good mortgages carry prepayment options that allow you to increase your mortgage payments at any time. These payment increases can be used to reduce your amortization back to its natural schedule when your budget allows. Discipline is key.

Question #5: Can I trust a bank for mortgage renewal advice?

YES NO IT DEPENDS

Trust the experience and knowledge of the individual you are getting advice from, not the lender.

Question #6: What piece of advice would you pass on to anyone looking to renew their mortgage?

Your mortgage debt is large part of your financial position. It provides your family with shelter and should be a boring part of your financial portfolio. Most should not gamble with it. Payment stability is extremely important, and that has proven itself over the past couple of years.

Broker Name: Shirl Funk

Broker Company: Shirl Funk Mortgages Ltd

Question #1: What is the best type of mortgage to have right now?

VARIABLE RATE FIXED RATE

Fixed: 1-3 year terms so the client is not locked in for too long should rates drop.

Question #2: What is the best rate you can get right now? (Specify rate and term length)

VARIABLE RATE FIXED RATE

Fixed: 4.895 high ratio insured mortgages.

Question #3: Should I get out of my variable mortgage if I have one?

YES NO

No, if you are comfortable and have the ability to pay.

Question #4: Should I opt for a longer amortization period?

YES NO

Yes, depends on your future plans.

Question #5: Can I trust a bank for mortgage renewal advice?

YES NO

I would suggest seeking advice from a mortgage broker.

Question #6: What piece of advice would you pass on to anyone looking to renew their mortgage?

Ask yourself if you can support your payments long term, even if rates go up.

- With files from CTV's Jeff Keele

CTVNews.ca Top Stories

BREAKING Donald Trump picks former U.S. congressman Pete Hoekstra as ambassador to Canada

U.S. president-elect Donald Trump has nominated former diplomat and U.S. congressman Pete Hoekstra to be the American ambassador to Canada.

Genetic evidence backs up COVID-19 origin theory that pandemic started in seafood market

A group of researchers say they have more evidence to suggest the COVID-19 pandemic started in a Chinese seafood market where it spread from infected animals to humans. The evidence is laid out in a recent study published in Cell, a scientific journal, nearly five years after the first known COVID-19 outbreak.

This is how much money you need to make to buy a house in Canada's largest cities

The average salary needed to buy a home keeps inching down in cities across Canada, according to the latest data.

'My two daughters were sleeping': London Ont. family in shock after their home riddled with gunfire

A London father and son they’re shocked and confused after their home was riddled with bullets while young children were sleeping inside.

Smuggler arrested with 300 tarantulas strapped to his body

Police in Peru have arrested a man caught trying to leave the country with 320 tarantulas, 110 centipedes and nine bullet ants strapped to his body.

Boissonnault out of cabinet to 'focus on clearing the allegations,' Trudeau announces

Prime Minister Justin Trudeau has announced embattled minister Randy Boissonnault is out of cabinet.

Baby dies after being reported missing in midtown Toronto: police

A four-month-old baby is dead after what Toronto police are calling a “suspicious incident” at a Toronto Community Housing building in the city’s midtown area on Wednesday afternoon.

Sask. woman who refused to provide breath sample did not break the law, court finds

A Saskatchewan woman who refused to provide a breath sample after being stopped by police in Regina did not break the law – as the officer's request was deemed not lawful given the circumstances.

Parole board reverses decision and will allow families of Paul Bernardo's victims to attend upcoming parole hearing in person

The families of the victims of Paul Bernardo will be allowed to attend the serial killer’s upcoming parole hearing in person, the Parole Board of Canada (PBC) says.